Overview

In the early 1860s, the American Civil War caused cotton supplies, which had traditionally supported the western cotton trade, to be cut off. In England, this resulted in a depression known as the Lancashire Cotton Famine, however, in India it led to a period of great prosperity and wealth as cotton supplies in the East and Orient were suddenly in great demand.

Famine and Decimated Harvests

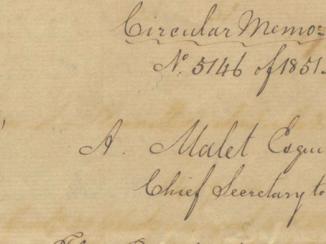

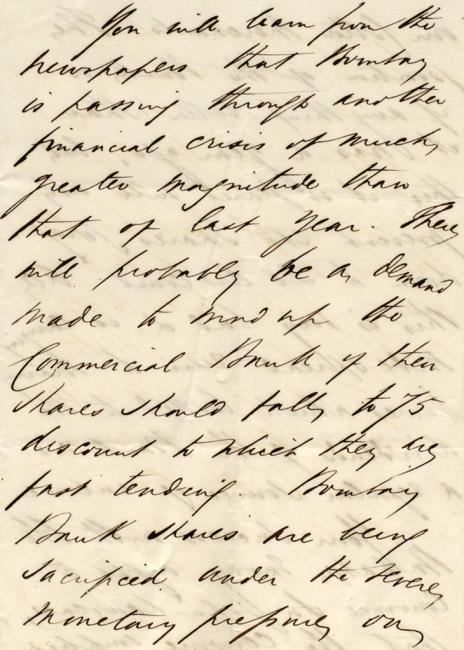

This abrupt increase in wealth led to widespread speculation on cotton and the formation of numerous financial and banking institutions. However, in 1866, a widespread famine led to a radically reduced cotton harvest as cotton farmers gave over their fields to produce foodstuffs. The Commercial Bank of Bombay, at the time the principal bank in Bombay, collapsed and, in 1868, went into liquidation. The background to the crisis and the likely decision to wind-up the bank are discussed in a letter from Patrick Ryan to Lewis Pelly written in 1866.

This decision was of great concern to the many British citizens resident in India and the East and in particular for many employees of the India Office The department of the British Government to which the Government of India reported between 1858 and 1947. The successor to the Court of Directors. and Indian Army, who had invested a great deal of their money in the bank and had become shareholders. These individuals believed that the bank had publically defrauded its customers. They had placed their money with the bank in good faith based upon its annual statement for 1865; now not only would they no longer receive their dividend but they were also potentially facing the loss of their savings and shares.

Failing Banks

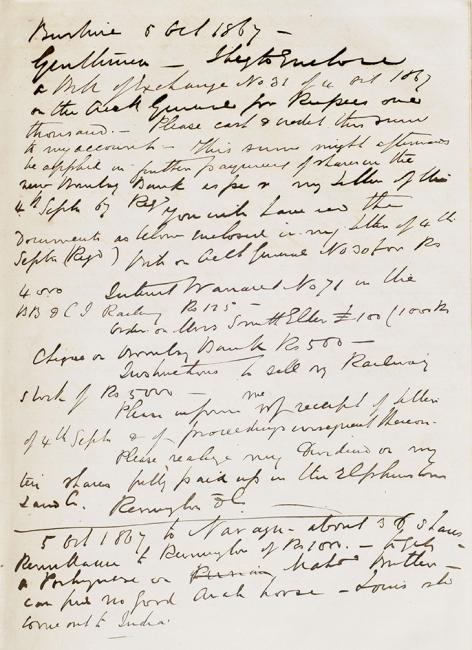

A further difficulty presented itself when, in 1867, the New Bank of Bombay was established to replace the Commercial Bank of Bombay. Its customers faced the daunting challenge of recovering their savings and investments from the old bank and purchasing new shares and establishing accounts in the new bank.

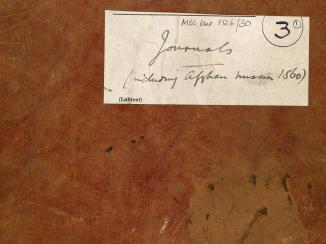

Lewis Pelly was one such customer: he had held thirty-six shares in the Commercial Bank of Bombay and his attempts to be reimbursed for the value of these shares upon the opening of the New Bank of Bombay are documented in a series of forty-two letters to his agents and contacts in Bombay over the period 1867–69.

The letters document in detail the lengths to which Pelly went in order to gather together sufficient funds to purchase seventy-two shares in the New Bank of Bombay, which had a much higher purchase price than the shares he had previously owned in the Commercial Bank. These letters register Pelly’s process of acquiring the money back from his old shares, cashing in the credits he had due, arranging to transfer his personal savings and selling shares he possessed in numerous companies such as the Elphinstone Land Company.

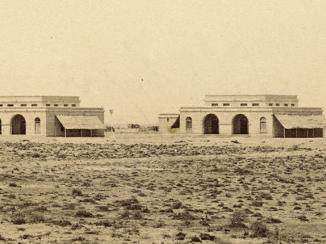

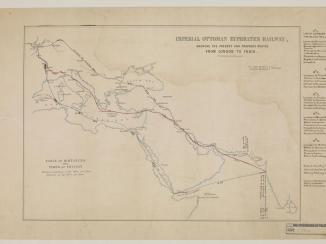

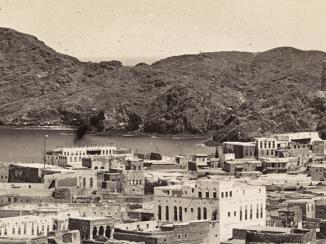

For Lewis Pelly it meant potentially losing valuable assets in the form of his shares in the bank and also losing the means to receive his pay from the India Office The department of the British Government to which the Government of India reported between 1858 and 1947. The successor to the Court of Directors. and to authorise and receive payments relating to goods and services as part of his daily work as the British Resident in the Persian Gulf The historical term used to describe the body of water between the Arabian Peninsula and Iran. . More broadly, the correspondence illustrates just how dependent those working for the India Office The department of the British Government to which the Government of India reported between 1858 and 1947. The successor to the Court of Directors. were on the banks in Bombay and the disruption and chaos that was caused by the Bombay Banking Crisis.